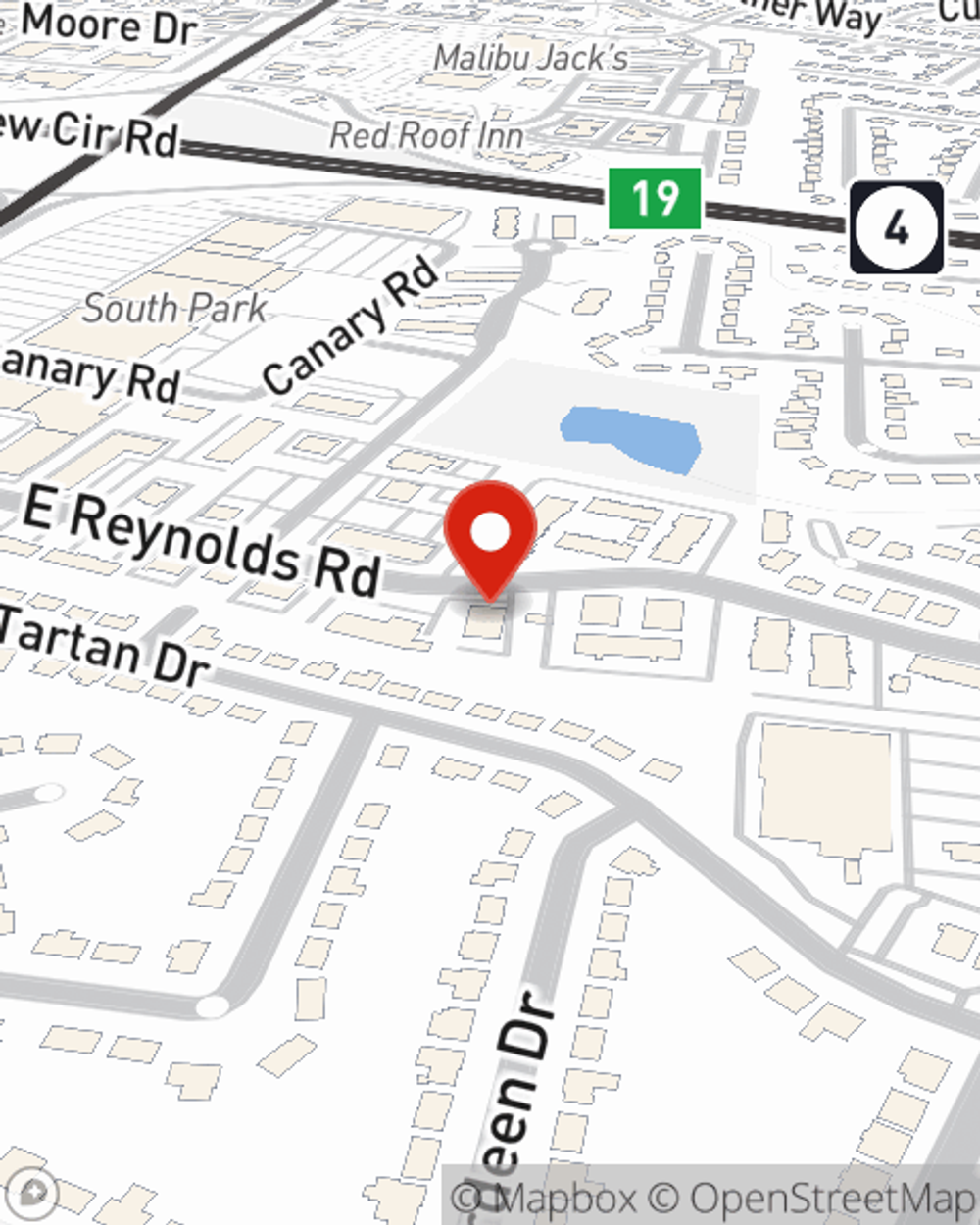

Life Insurance in and around Lexington

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Lexington, KY

- Nicholasville, KY

- Georgetown, KY

- Woodford County KY

- Richmond, KY

- Winchester, KY

- Berea, KY

- Harrodsburg, KY

- Stamping Ground, KY

- Cynthiana, KY

- Carlisle, KY

- Wilmore, KY

- Salvisa, KY

- Midway, KY

Check Out Life Insurance Options With State Farm

It can be what keeps you going every day to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can pay for college and/or pay off debts as they grieve your loss.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Put Those Worries To Rest

Fortunately, State Farm offers many coverage options that can be personalized to fit the needs of your loved ones and their unique situation. Agent Levi Monk has the personal attention and service you're looking for to help you choose a policy which can assist your loved ones in the wake of loss.

Simply get in touch with State Farm agent Levi Monk's office today to find out how a State Farm policy can help cover your loved ones.

Have More Questions About Life Insurance?

Call Levi at (859) 286-9669 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.